How Financial Mainstream Media Impact Our Risk Taking Behavior

Yes, Fear-Based Reporting Impacted our Ability to Take Risk and Grow

A recent article from the University of Cambridge appeared on my Google newsfeed, "Boom and bust? Millennials aren't all worse off than Baby Boomers." It gives an interesting update that millennials have achieved something remarkable—they have become a majority-homeowner group.

This article is different from all the others I have read. It seems I (as a millennial) am not as financially disadvantaged as I always thought. That was refreshing. The headline that I used to hear label our generation as, “Screwed”, or “Dream”, or “Financially irresponsible”. Maybe the savings on avocado toast and coffee that we adopted throughout these years has helped us become financially “on time.”

Ever since graduating from college in 2018, I have heard about how behind financially we are as millennials. But now, the narrative has changed - it focuses on the concern about personal finance around Gen Z. For example, the media is now telling all of us (specifically Gen Z) that Gen Z is financially screwed, and they fear for the future. (link) It feels like the media is giving an ultimatum to every college graduate out there not to get too excited about adulthood.

Is that something that we really need to fear about?

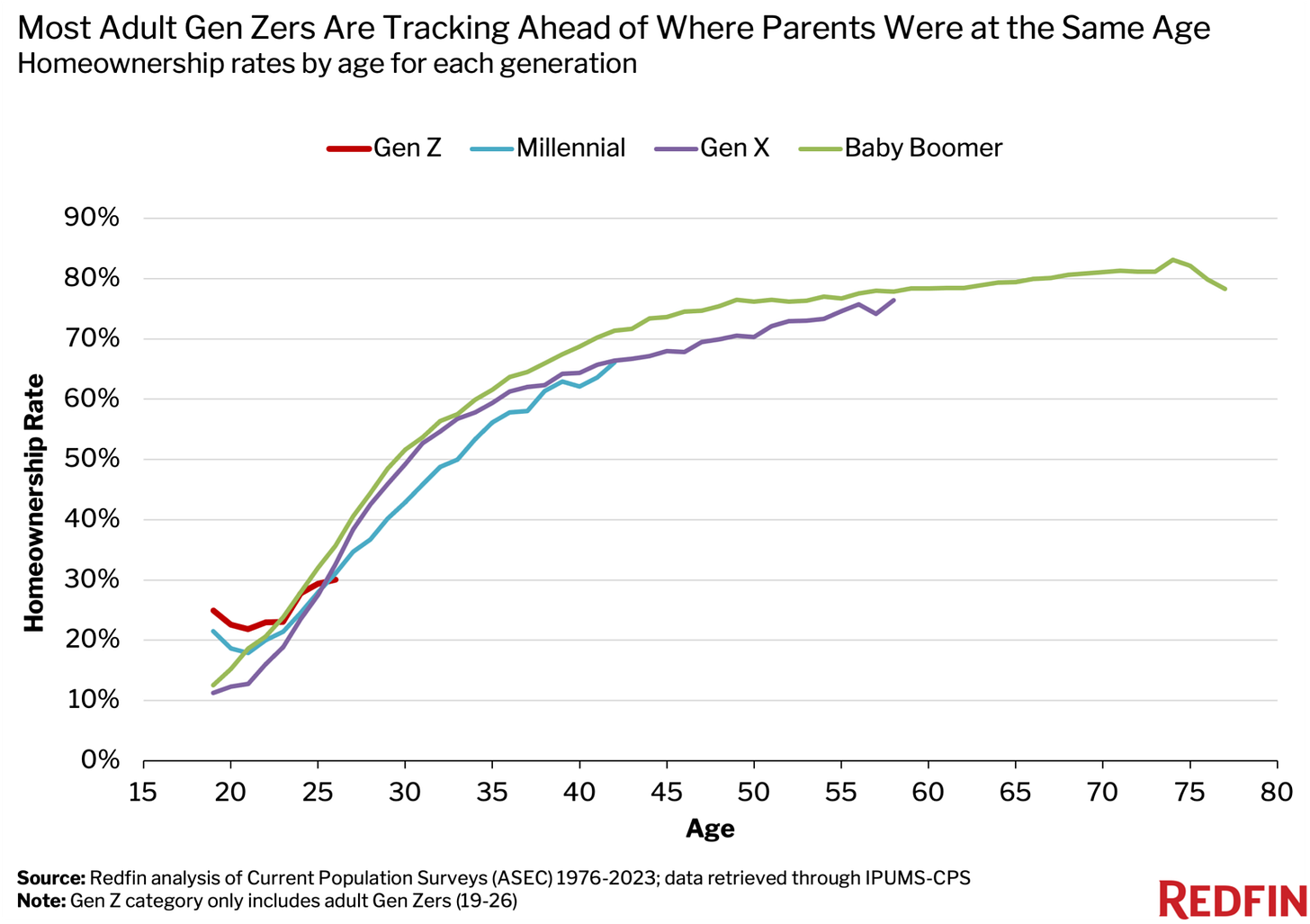

I decided to do some research, and after looking at Redfin data, I discovered that adult Gen Zers' homeownership rate fares better than that of past generations.

As you can see on the above graph (link), the homeownership rates for 19-25-year-old Gen Zers are higher than those for millennials and Gen Xers when they were the same age. The rate for 24-year-old Gen Zers is 27.8%, compared with 24.5% for millennials when they were 24 and 23.5% for Gen Xers when they were 24.

These financial news articles often depict the current situation as the worst possible situation that we will ever encounter and that we should always look at our future as bleakly as possible. They have done a great job manipulating narratives to provoke fear and anxiety, which captures readers' attention and drives engagement. The good news is that more audiences today understand these tactics and are more skeptical of what is presented in the media. But I saw that this problem is a recurring theme - when every news outlet tells you that the sky is falling, it is hard for our subconscious mind to stop believing it is falling.

The media is right—our feature is in danger not due to the reporting but because the fear-based tactic of reporting has caused a scarcity mindset amongst every new generation. The news around us has altered our perspective on the future that we are, putting us in a scarcity mindset impeding our long-term financial and personal growth.

The Risk of Scarcity Mindset

The impact of a scarcity mindset makes us focus on immediate needs, like financial stability and basic survival. This can prevent us from thinking about long-term goals such as investments and growth opportunities. Sendhil Mullainathan and Eldar Shafir's published book, Scarcity: Why Having Too Little Means So Much (link), explains how a scarcity mindset—whether of time, money, or opportunities—narrows our focus and makes us less willing to take risks.

The scarcity mindset also makes us fear failure, which creates zero-sum thinking about the future. We prioritize job stability over pursuing high-risk, high-reward opportunities or changing careers. A survey by the Pew Research Center (link) found that Millennials and Gen Z are particularly concerned about job security, and media reports about the labor market challenges reinforce their reluctance to take career risks like switching industries or starting new ventures.

Looking back, the 2020 lockdown, followed by the news about tech lay-offs had me (and everyone around me) feeling anxious about our software engineer career. As a result, a lot of us stayed put and didn’t take any action to pursue the opportunity that was presented to us. However, my mentor had reminded me that the news was an amplification of what was actually happening. They have lived through major economic events like the dot-com bust in the 90s, and the 2008 housing bubble. I guess we get calmer as we grow older because we have experienced so many downturns in our lives that we have some incidents to compare them with.

Lastly, the scarcity mindset creates the feeling of losing control over the future. It creates a perpetuated cycle of worrying over losing what we have and creates stress that affects our mental health.

People with a scarcity mindset often refuse to let go of activities or situations that no longer serve them, such as staying in an unfulfilling job. Constantly needing to keep up with the job that doesn’t serve us leaves us feeling trapped and burnout.

Trust But Verify

Don't accept everything the media says at face value.

Five years ago, the news and media warned that houses in Silicon Valley were in a bubble. They said that those who bought real estate during that period would see a drastic drop in value. Fast forward to today, my friend who bought houses in Silicon Valley during that time had enjoyed the equity of a lifetime. When I asked him why he had the guts to purchase his home, he said, “Looking closer at the data, I don’t believe that Silicon Valley home will ever tank. There are more people moving into Silicon Valley than those who are moving out, and the place is already known for its innovation and technology that it is very hard for a company who wants great talent to not come to Silicon Valley.”

When you read an article, pause and ask yourself, "What's the bigger picture here? Is there any actionable insight behind this, or is this mainly fear-based reporting?" Whenever you encounter a scarcity narrative, seek data or opinions that provide different perspectives. Focusing on the bigger picture can help reduce the emotional impact of short-term fluctuations in negative news.